Terminal Velocity: The Economic Death Trap

America’s Trade Deficit Is a Death Spiral Disguised as Business as Usual

By the time the smoke becomes visible, the building's already gone. You just haven't noticed it yet, and by the time you notice that the building has vanished, it’s far too late for any meaningful recourse.

This is a two-part article:

First, the analysis of the U.S. Census Bureau and the U.S. Bureau of Economic Analysis. It’s coming at you with a wealth of data, some creative language to loosen it up a bit, and a summary.

Second, below Part 1, we’ll break it down in an “Evaluation for the rest of us”. Basically, less of the hoity-toity language, more of what the hell is really going on.

Dig in.

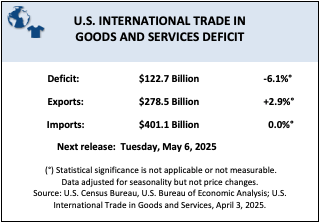

That’s the real headline buried under February’s U.S. International Trade in Goods and Services report. The message does not cease with the $72.1 billion trade deficit figure, the graphs, or the buried corrections. The true story is that we are in economic free fall, with 77 million Americans still smiling and waving as we plummet toward the rocks. Somehow, in our deeply indoctrinated “America is God’s Country” delusion, we are convinced that our terminal velocity is somehow a sign of national strength.

Once we hit the rocks of economic reality, though…

If you like some stale reading, here’s the full report:

The U.S. trade deficit widened again in February 2025, up from January’s revised figure, ticking ever higher like a metronome counting down to collapse. Goods alone gouged a $96.5 billion hole, only mildly offset by a shrinking services surplus of $24.3 billion. Exports of capital goods and cars did a little dance upwards, while imports, fueled by our unquenchable thirst for consumer crap and the erosion of domestic production, surged even higher.

What does that tell you?

We’re exporting slightly more, but importing even faster. The treadmill’s speeding up under our feet, and the belt is greased. A slippery slope.

A Quick Glance

Goods Exports Up ($8.4 billion): Led by computer accessories (+$0.9B) and civilian aircraft (+$0.5B), our “victories” are a high-wire act strung between aerospace subsidies and tech sector churn. Capital goods remain our Hail Mary, but a Hail Mary doesn't fix the scoreboard when you're down by 50 points.

Goods Imports Up ($8.9 billion): The real issue. Imports are growing faster than exports, and the drops in fuel oil (-$1.0B) and “other goods” (-$1.3B) don’t even dent the tide. We’ve built a nation that eats what it doesn’t produce and borrows what it can’t earn.

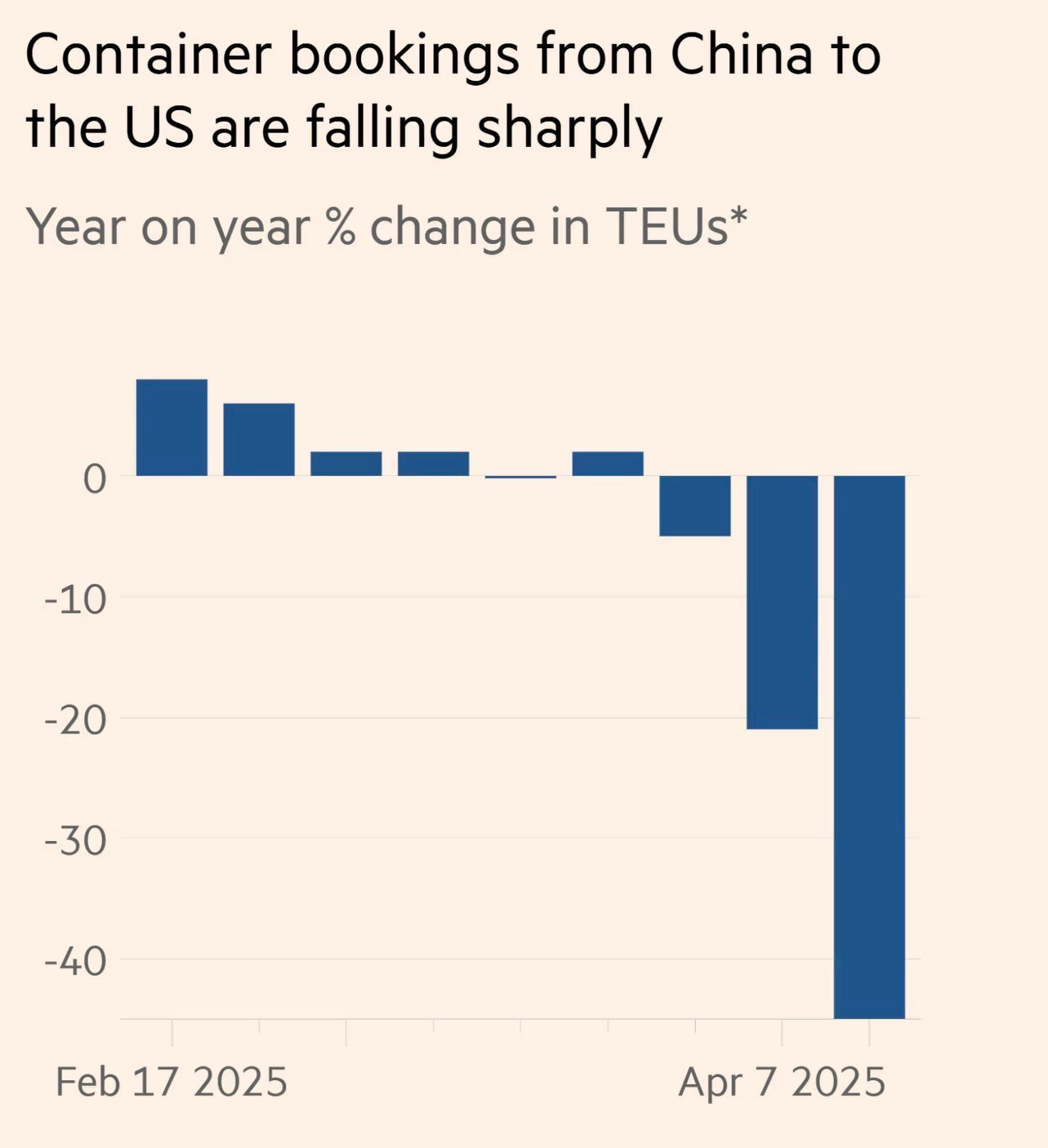

The imports have grown faster in response to the tariffs. Organizations saw this coming, and they stocked up.

Now, the shipping industry is empty. What we’re experiencing is the delay of numbers, expressed in the form of import self-defense.

Services Surplus? Shrinking. Exports of services fell by $0.4 billion, and imports ticked up. Even America's most reliable offering, our ability to sell expertise, legal work, finance, and tourism, is starting to wilt. Services were supposed to be our insulation, our post-industrial safety net. It’s fraying.

It’s worse than you think, because this isn’t a one-off blip. Look closer, and you’ll see the three-month moving average: a slow, grinding, worsening deficit trend since late 2024. A death spiral in slow motion. A nation losing the trade war, propped up by a guy with an orange spray tan in a suit, supported by minions who are too scared or bought-in to tell us what’s really happening.

The Error is in the Stats

Seasonal adjustments and statistical methodology don’t cover the rot. Here’s what’s baked into these numbers:

Goods figures are compiled from Customs documents, but underreporting, undocumented shipments, and “low-value transactions”.

Services data are softer still, prone to error and constantly revised. The revisions often take place after the fact, when nobody’s paying attention anymore.

The Canada Border Services Agency’s (CBSA) new system (CARM) could soon distort cross-border trade numbers further. Meaning, next year’s true values will be even harder to read.

The Mirage of “More Exports”

Whenever these numbers come out, some desperate spin doctor somewhere will chirp, “Exports are rising!” as if that’s proof of vitality.

But they’re missing the punchline: if imports are rising faster, exports don’t matter. Especially when future imports carry massive tariffs.

January 2025 revisions? Goods exports were bumped up by $0.8 billion.

Imports revised down by $0.1 billion. A rounding error.

You don’t survive by losing more slowly.

Ok, enough of the high-level language.

This is Part 2 - for the rest of us.

If you think these numbers are ugly now, wait until the government “revises” everything this summer. In June 2025, the Bureau of Economic Analysis and the Census Bureau will rework trade figures going back to 2018.

Why? Because reality keeps slipping through the cracks, and the illusions need patching. They’ll tell you it’s all about “methodological improvements.” But you don’t need a PhD in economics to smell the rat: they’re softening the battlefield for the real hit.

The March report, due May 6th, will almost certainly be worse. By then, the tariffs, supply chain bottlenecks, and global retaliation will have started to really bite. And the bite will show in the numbers.

Then, it becomes a question of “How do we sell this to the public?”

They’ll likely blame it on “unexpected global turbulence” or “transitional pressures.”

They won’t say what’s true: it was engineered.

What You Should Be Watching

The three-month moving average: It’s your canary in the coal mine. If the average keeps rising, forget month-to-month noise. We’re in free fall.

Capital Goods Exports vs. Imports: If we’re selling less tech and buying more consumer junk, it’s a signal that our production base is rotting underneath the facade, compounded by tariffs on the way into the country.

Services Exports Collapse: If tourism, financial services, and IP licensing start bleeding out faster, the collision will be unavoidable.

Do a 360: Evaluate what’s on the shelves, how prices change, and whether there are shortages of goods and products. Whether you need them or not, walk through the aisles with your eyes wide open. Chances are, once the supplies of retailers are running out, nothing is coming in.

Per CNBC: The pullback in trade between the U.S. and China as a result of President Trump’s steep tariffs on Chinese goods and fears of a recession are starting to show up in major ports data, with a steep drop in container vessel traffic headed to Los Angeles and Long Beach.

For the week ending May 3, the number of freight vessels leaving China and headed to the Southern California ports, the main U.S. ports receiving Chinese freight and other Asian trade, is down 29% week-over-week, according to Port Optimizer, a tracking system for ships. Year-over-year, the data shows a 44% drop in vessels scheduled to arrive the week of May 4-May 10.

If you’re interested, the Port of Los Angeles has a daily updated dashboard. Access the “Port Optimizer” by clicking the image below:

The Bigger Picture: This Isn’t a “Correction.” It’s a Transition.

Understand this: what’s happening isn’t a mistake. It's a controlled demolition. A deliberate shift from national production to corporate arbitrage, from sovereignty to servitude. We’re being rebranded, repackaged, and resold. The general public will be asset-stripped like a rusting factory in a bankruptcy court. The wealthy will be able to sustain the shortages, and if the opportunity presents itself, they will buy assets for pennies on the dollar. When small to medium businesses go bankrupt, they’ll be waiting. The same is true for real estate, farmland, etc.

In the end, this isn't about “global competition.” It's about national liquidation.

We’re all conditioned to believe that a collapse will go off like a flash bang. It won't. It’ll look like this: another $72 billion a month, another $75 billion, another $80 billion. Diversified across multiple domains. From small business manufacturing to real estate to farmland.

Next, consumer credit collapses under interest rate pressure, and as forecast, it won’t be the billionaires paying the price. It’ll be the little people first: the savers, the hard workers, the cautious ones who did everything “right” according to the rules of a rigged game.

By the time the March numbers hit in May, it’ll be too late to pretend this is normal. By June, after the “annual revisions,” the real damage will be locked in.

We can acknowledge this now, or be impacted by it later.

From this post:

The Next Crash Is Already Here: Recession, Rupture, and the Rot in the System

By the time you see the smoke, the fire's already gutted the floor beneath you.

Came this question: thenastywoman

So What Should the Little People Do?

Now, if you’re sitting there, like one “The Nasty Woman”, and 60% of other Americans who live paycheck-to-paycheck, with a few dollars in a savings account, no stocks, no land, and too little capital to play in the big casino, it’s natural to feel paralyzed.

To some degree, we still have options, but they won't come gift-wrapped or with any form of ease.

Also, there’s again, no silver bullet, but age-old advice that requires discipline, acceptance of the futility of our condition, and an iron will to not let the oligarchy win.

1 - Diversify away from bank risk where possible. Keeping a few months of emergency cash physically accessible (but safely hidden) is wise. In an economic downturn, banks may become increasingly unstable, and during crises, access can be frozen faster than you can blink.

In other words: Yes, the money is yours. No, they will not play fair and let you have it when mass withdrawals start. Fractional banking gets in the way of that idea.

Fractional banking is a bitch:

Before March 2020: The Fed required banks to hold a percentage of their transaction accounts (like checking accounts) as reserves.

However, in March 2020, the Fed lowered the reserve requirement to 0% for all banks, eliminating the need to hold a specific percentage of deposits in reserve.

Despite the 0% requirement, banks still hold reserves for:

Operational Needs: To manage day-to-day operations, like clearing payments and facilitating customer withdrawals.

Liquidity: To ensure they can meet their financial obligations and maintain stability, as long as not too many customers withdraw at the same time.

However(!!!!), when mass withdrawals were to start, banks do not have liquidity on hand to facilitate these requests = you won’t get what’s yours.

But what about the FDIC? Well, read NPR and Finance.Yahoo

2- Small, tangible assets matter. If you can't buy property, buy value: a water filtration system, solar panels, durable tools, seeds, and nonperishable food.

Real things that hold utility when paper wealth evaporates.

3 - Move some savings into hard stores of value. If you can afford even small amounts of silver or gold, do it. They're not “investments” right now, but they might be life preservers.

4 - Stay liquid and mobile. If America’s situation worsens (and it will), having the ability to relocate, even if just within your own country to safer, less volatile areas, it could be the difference between surviving comfortably or surviving barely.

You don’t have to be rich to preserve your future. You have to move early, move wisely, and remember: small moves made before the crowd panics are worth more than big moves made afterward.

Download the mini guide below:

In the world we're entering, resilience beats riches every single time.

###

~Z.

I got about halfway through and I have to save this for later. The insomnia is already untreatable! XX great job friend! (you are not giving me insomnia our country is)