The Next Crash Is Already Here: Recession, Rupture, and the Rot in the System

From Wall Street to Main Street, from debt spirals to land bubble. Three views show that a recession is the best possible, but a depression the most likely outcome.

By the time you see the smoke, the fire's already gutted the floor beneath you.

Economic collapse doesn’t erupt like a bomb. Quite on the contrary, it seeps in quietly, like carbon monoxide through the drywall of modern finance. No alarms, no flash bangs, just the slow, sweet promise that everything is fine. Until it isn’t.

We are likely beyond the point of “Isn’t”

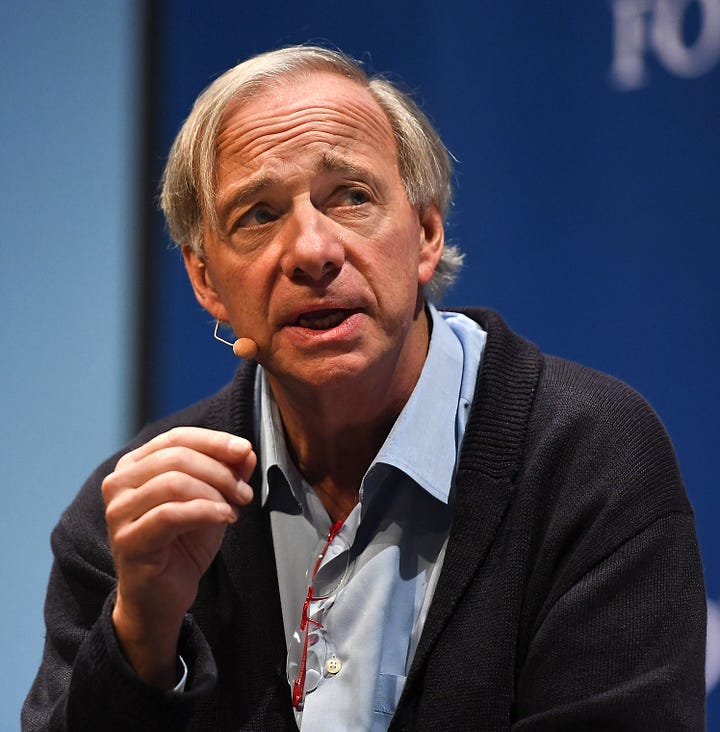

Surrounded by the early symptoms of systemic rot, revealed by voices as revered as Ray Dalio, Fred Foldvary (✝️ 2021), and a CNBC analysis = we are heading toward an irrecoverable collision course.

Three different vantage points, global macro, real estate cycles, and commercial banking fragility, converge on one painful reality: the foundations of our financial house are decaying and swaying in the breeze. A scaffolding about to break.

Before we dive in, Google’s NotebookLM provides the podcast version:

Dalio’s Forecast: When Five Storms Collide

Ray Dalio, the billionaire investor with a penchant for historical cycles and pessimistic realism, doesn’t use words like “worse than a recession” lightly. Yet, here he is, invoking the nightmare of the 1930s to describe today. Not one crisis, but five, according to Dalio, are merging:

A dysfunctional debt-and-credit cycle led by a government that spends like no one’s watching

Political fragmentation and wealth inequality, rotting nations from within.

China and others who own the means of production are itching to elbow the U.S. off its pedestal as global trade superpower.

Climate and pandemics are turning nature itself into a weapon.

And finally, technology. Crisper than wisdom, faster than policy, and largely in the hands of those chasing profits over purpose.

These aren’t isolated issues. They’re interlocking. Tariffs, for instance, are just the rash, “a symptom of a much greater problem,” Dalio says. “Something worse than a recession” awaits if the system doesn’t course-correct (Dalio).

“We are going to change the monetary order,” he warns, “because we cannot spend the amounts of money we’re spending.”

He’s not being rhetorical. He’s describing the early collapse of monetary confidence. The kind that sent Germany into hyperinflation and Argentina into barter economies. He fears we’re nearing a “breaking down of the monetary order,” with ripple effects on the domestic social fabric and global alliances.

Worst case scenario? That money itself could lose its meaning.

"The value of money… internal conflict that is not the normal democracy as we know it, and international conflict in a way that is highly disruptive to the world economy and could even be a military conflict..." – Ray Dalio

Foldvary's Clock: The Depression of 2026

Unfortunately, Fred Foldvary died on June 5, 2021. Nonetheless, his work is just as relevant and his words are just a true in 2025. In that, Dalio’s macro-level fears find eerie harmony in the work of Fred Foldvary, who made waves back in 1997 for calling the 2008 crash long before it happened. He argued that we're not in the grips of a mysterious business cycle, but we’re victims of government-induced real estate bubbles, compounded by corporate giveaways, like lemmings pushed toward cliffs paved by land subsidies and interest-rate manipulation.

Foldvary zeroed in on a cycle: the 18-year real estate rhythm. It’s structurally surprisingly simple:

The government artificially boosts land values via tax incentives and cheap credit.

Prices rise.

Speculators swarm.

The bubble peaks before it bursts.

The crash obliterates equity and confidence.

According to this cycle, and the last crash having been in 2008, the next scheduled bloodletting isn’t far off.

“The most likely year for the next great recession is 2026,” noting that this time, the carnage may outstrip 2008. “US bonds will no longer be considered safe…” (Foldvary).

The fuse? Unsustainable debt, toxic land speculation, and public blindness to both.

“Americans still have time to prevent the next great boom and bust, but they are culturally bound to the status quo... so the warnings will go unheeded.”

The Banking Sector: Death by a Thousand Loans

Meanwhile, CNBC’s postmortem on the collapse of Silicon Valley Bank, Signature Bank, and others is less about theory and more about triage. The headlines scream “isolated incidents.” The data says otherwise. Granted, the CNBC bit is from January 23, 2025, before tariffs and before the full effects of the Trump administration had hit the American markets. Back then, CNBC summarized that:

Nearly $929 billion in commercial real estate loans matured in 2024. The effects have not fully hit the books yet. The impact is time delayed. (CNBC)

Many of those are on the books of community banks. That’s the $1B–$10B institutions whose balance sheets can’t absorb high-interest defaults. (CNBC)

Banks are hemorrhaging money on low-yield bonds. (CNBC)

And confidence? Well, as they bluntly put it: “Confidence is everything. Lose that, and even healthy banks start dying.” (CNBC)

The problem is structural. These aren’t rogue banks taking rogue risks. They are ordinary institutions caught between the future of rising rates and falling collateral values. M&A activity is drying up. Regulators are too late, again. Sound familiar?

However, that was in January. The velocity toward doom has picked up speed.

We may very well be headed toward a revival of “too big to fail”. While it should be “too big to exist”.

Converging Nightmares

What happens when Dalio’s global storm collides with Foldvary’s real estate time bomb and CNBC’s real-time bank stress?

Collapse becomes not a matter of if, but of how fast and how messy.

Dalio fears a breakdown in the monetary order. Hyperinflation, capital flight, and military conflict are on his horizon.

Foldvary saw a mathematical certainty in real estate collapse. A level of collapse that government will be too paralyzed, incompetent, or captured to prevent.

The CNBC report shows cracks forming, with banks entering default zones ahead of schedule.

Altogether, though, these aren’t three separate stories. They are chapters in the same book.

What’s at Stake? Everything.

If even parts of this threesome unfold as forecast, we’re looking at:

Currency devaluation and capital evacuation.

Wealth destruction for the middle and working class.

Consolidation of power among monopolies and mega-investors, who will swoop in like vultures on a fire sale of the USA.

Politicians are promising salvation while delivering surveillance, accentuated by the removal of individual rights.

In Dalio’s words, “Such times are very much like the 1930s.” But unlike the 1930s, today’s crises aren’t confined to one country or one sector. The web is tighter and the fall is deeper. Foldvary said the only escape from the 2026 crash is a controlled deflation of the land bubble, rather than riding it to the max and letting it burst. The CNBC analysts appeal to regulatory vigilance and private-sector recapitalization.

However, if you pay attention to the regime, you know that they won’t “fix it”.

Not with this Congress. Not with this government administration. Not with a population trained to binge on dopamine, not data.

Meanwhile, we should prepare not for a single crisis, but for a cascade of suffering, uncertainty, and the potential for significant financial pain for those who already live paycheck to paycheck.

You don’t need to be an economist to smell the smoke. You just need to believe your eyes before the flames start crisping your skin.

Prepare Like No One’s Coming to Save You

Before you read this final paragraph, the disclaimer is that I am NOT a financial advisor. I’m merely paying attention, connecting dots, thinking from the perspective that the ruling class is not trustworthy and will come after our last cents, turning us into more of the eternal serfs than we already are.

Arrogantly, I presume that if you’re reading this, you’re likely thinking in similar terms as I do. Ideally, that puts us ahead of most. But, are we acting like it? If we did, we’re forced to diversify out of fantasy. We should all dump our holdings, like Warren Buffett did, reducing exposure to overleveraged stocks, speculative tech, and anything riding a hype wave. Getting liquid is the key agenda. However, keeping Dalio’s perspective in mind, monetary liquidity may not be the solution. Beyond that, keeping it local is the second most important perspective. Following Foldvary, reassess your exposure to real estate, especially if you're overleveraged or banking on endless appreciation. If you own, hold tight and secure your equity. If you're renting, stay nimble. Moreover, consider your exposure to depreciating assets. That car note could send you into a death spiral (I need to take my own advice here).

If you can, besides holding cash, although Dalio would shake his head in disapproval, shift some assets into alternative stores of value: precious metals, select crypto, and yes, even real-world assets like farmland. Although crypto is highly speculative, if big players are in Bitcoin, it is worth considering if you have the stomach for 24/7 fluctuations. The same is true for farm land. Yes, it’s real estate. However, it’s also a hedge that you can do more with than a residential building in suburbia. Last but not least, if you have any talents, connections, or community partnerships that pivot you to self-sufficiency, start them now. Annoyingly, NONE of this is revolutionary, I know. That’s because there isn’t anything new or shockingly different about the approach.

Mitigate Risk. Minimize Risk. Ideally, Eliminate Risk.

Economic shocks favor the prepared and punish the inactive.

Lastly, don’t wait for political leadership to fix this. They won’t. In fact, they will make it worse, and if they have their way, it will never get better. And you cannot sustain “worse”. You need better. Now. Thus, build resilience in your own life and your immediate community. Find local suppliers, network with people who have practical skills, and adopt the perspective that the best insulation from collapse isn’t just capital. It’s competence.

###

~Z.

Sources:

YouTube: Ray Dalio, CNBC, Progress.org

Well, I have no assets, no accions in the stock market, only a few euros in my savings account, not enough to buy property in Europe, maybe a tiny piece of land somewhere else.... so, what should I do? Should I take the money out of the bank, keep cash, buy something? What can you advise to little people like me, with little money but much to lose?

The only thing I can add is I have $19G in a credit union and my credit card debt is now down to $750🥹