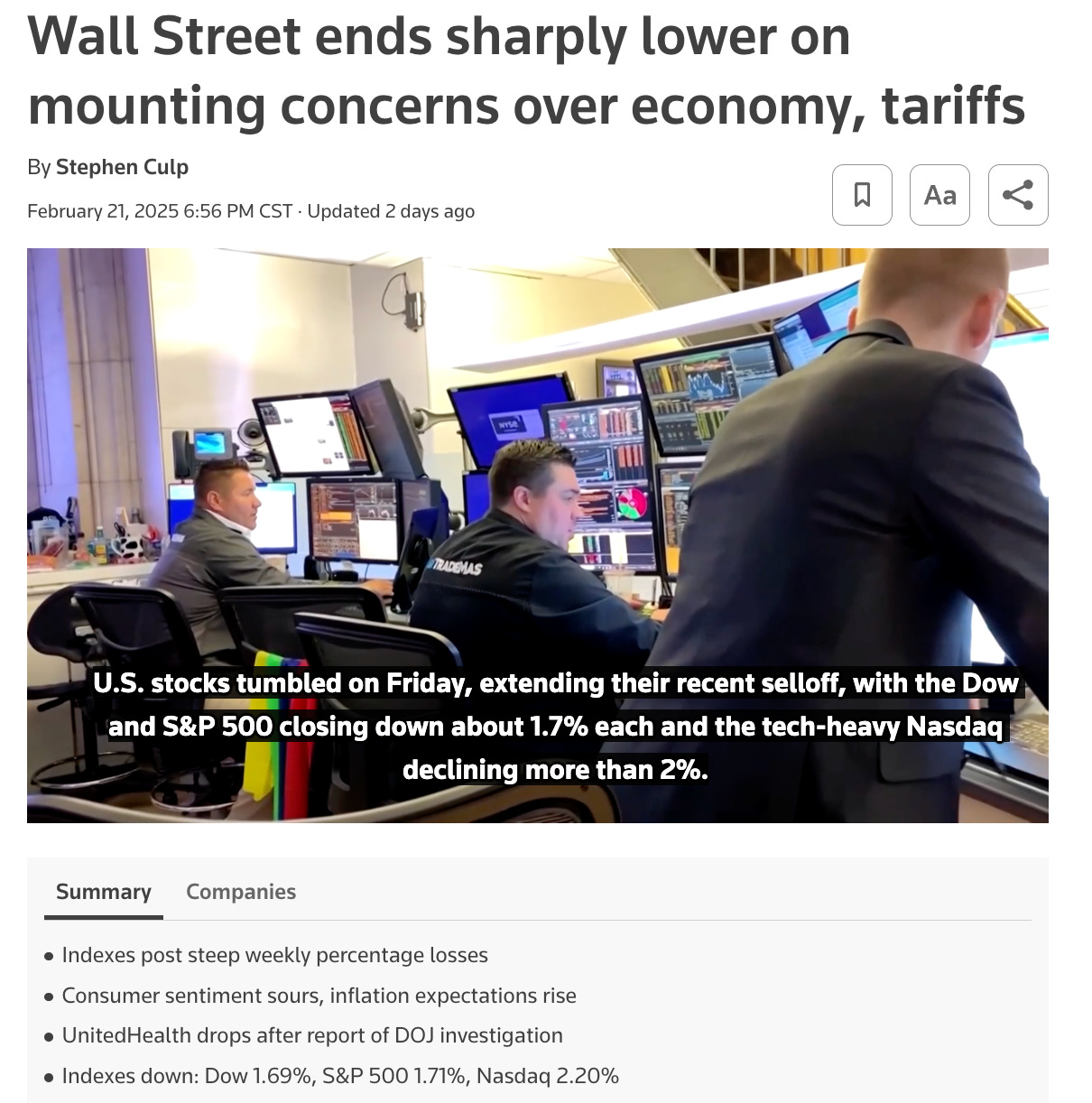

The U.S. Economy Is a Controlled Demolition: Who’s Holding the Detonator?

We're sold down the river by liars & crooks, hiding behind “fiduciary responsibility”

During today’s writing session, I talked with June, the owner of my local bean juicery (coffee shop). As we usually do, June and I talked about her business, staff, and how things are going.

Evaluating in the midst of Q1 of 2025, June has already seen a 20% reduction in revenue. Her café is usually slam-packed. Not anymore. These days, patrons come in waves, and the average ticket value has significantly decreased. June, ever community involved, asked how her regulars are doing. She now knows that people have started to save, preserve, and prepare. “They’re,…we’re all uncertain”, she told me.

She’s contemplating one of three (4) options:

She hopes that regulars keep coming and the average ticket value increases again soon - although “hope” is a bad business strategy.

Add 30 cents to each product sold. However, she is clear that this will negatively impact her customers, so it becomes a mathematical forecast: Take the risk of an increase, hoping to offset the loss of some patrons who are now priced out of consumption, while generating a fractional increase in revenue.

Reduce staff. This hurts. June is an employer who’ll give her last blouse before she considers reducing headcount.

This isn’t really an option: Double down on “hope”, facing the consequence of closing, if “hope” doesn’t work out in her favor. Closing would mean that a local staple, a privately owned coffee shop would cease to exist. A place of community - gone. A local employer - done.

From a micro perspective, this is the blitz impact of the Trump administration.

Unedited: Audio Summary by Notebook LLM (a Google AI)

Zooming Out into the Macro Perspective

As June is impacted, so are millions of other small business operators. The lifeblood of the United States economy, 33.2 million small and micro businesses, are fighting for survival. These businesses, collectively, create more than 1.5 million jobs each year, which is 64% of all new jobs. This is where we arrive at macro perspectives, and we have to ask bigger questions. The Blitzkrieg of the Trump administration is not confined to egregious social policies but expands into a blueprint for economic destruction. Thus, the question…

Who Profits from Collapse?

Hedge Funds & Private Equity: The Economic Vultures

Hedge funds and private equity firms thrive in times of economic uncertainty, leveraging crises to buy distressed assets for pennies on the dollar. Some of the most notorious financial firms leading this charge include:

· BlackRock & Vanguard -- They’re well-known financial behemoths that control over $20 trillion in assets and have a stranglehold on stock markets, real estate, and commodities markets. When crises hit, their vast liquidity allows them to swoop in and acquire failing businesses, solidifying their market dominance.

· Apollo Global Management & KKR -- Representatives of private equity firms specialize in buying distressed companies, slashing jobs, and extracting profits before flipping them for resale. Their aggressive acquisitions during the 2008 financial crisis are now being replicated in today's volatile economy.

· Citadel & Millennium Management -- Hedge funds engage in high-frequency trading and short-selling strategies that accelerate market downturns. When the market crashes, they profit while retail investors and pension funds absorb the losses.

However, those are only the entities that readily come to mind. In the case of June, the vulture waiting in the background is Starbucks. They would love nothing more than to see a local coffee shop fail, especially when the shop has significant history, a loyal customer base, and can easily be converted into a chain cafe (with shit coffee).

For every “June” and “local coffee shop” there are millions of other micro businesses, across all categories, where corporate behemoths have previously made “buy out” offers (which were rejected), who now lie in waiting.

These entities operate under the legal framework of fiduciary responsibility, promising returns to investors while simultaneously destabilizing markets and extracting wealth. Their strategies often involve leveraging complex financial instruments and regulatory loopholes to maximize profits, irrespective of the broader societal impact.

The Sears Collapse

In 2018, Sears filed for bankruptcy after private equity firms extracted billions from the retailer. Eddie Lampert, a hedge fund manager, used Sears as a personal piggy bank, siphoning funds into his hedge fund ESL Investments. Rather than reinvesting in-store infrastructure and employee wages, Lampert focused on financial engineering, stock buybacks, and asset stripping, leaving thousands of workers unemployed while he pocketed millions. This same playbook is being used today across numerous industries.

The Sears case exemplifies how private equity can gut a once-iconic American company, prioritizing short-term profits over long-term sustainability and employee welfare. The ripple effects of such collapses extend far beyond individual job losses, affecting entire communities, and subsequently, they are eroding trust in the financial system.

Billionaire Investors & Corporate Oligarchs

The wealthiest individuals in the U.S. have been offloading stocks and liquidating assets at an unprecedented rate. They know that the market is running on borrowed time and overvaluation. They are also anticipating a possible market correction. Thus, they liquidate now, and with cash on hand, they’re ready to pick up the pieces of the correction, riding the wave back to the top. In essence, they are waiting for the impact, so they can make more money on the upswing. Generally, that’s common trade and investor behavior; if it didn’t come on the backs of common Americans.

· Major Tech Executives -- Industry leaders have collectively sold off billions in stock over the past year, suggesting deep concerns about market stability. Meanwhile, average investors remain exposed to increasing market risks.

· Veteran Wall Street Investors -- Seasoned market players have been systematically reducing their exposure to riskier assets, accumulating cash reserves, and warning of an economic downturn, while their firms prepare to acquire distressed assets at fire-sale prices.

Their actions speak louder than words. Whales (big movers) show a profound lack of confidence in current market stability. Meanwhile, they publicly offer assurances of economic strength, yet their private financial maneuvers tell a different story. In short, they want to assure you that “we’re strong”, so they can sell off first, and at a higher dollar value. Behind them is a potential crash that those who did not divest will be exposed to without recourse.

In layman’s terms: They’ll lie to you long enough, and while you trust their words, they’re cashing out. Whether you go broke means nothing to them.

Then, they wait for the shoe to drop, and on the other side of the bloodstained coin, they’ll maximize profits by investing at the bottom, capitalizing on your misfortune.

The 2008 Housing Crisis

During the 2008 financial crash, Blackstone (a hedge fund) bought up foreclosed homes en masse, converting them into rental properties. This contributed to a long-term affordability crisis, pricing millions out of homeownership. Today, Blackstone and similar firms control a significant portion of the rental market, continually extracting wealth from working Americans who can no longer afford to buy.

Using a mix of its own investor capital and novel asset backed securities tied to rental streams, Blackstone spent billions to buy nearly 50,000 homes nationwide, building the largest private portfolio of single family homes in the country. Most of its purchases came in areas hard hit by the real estate downturn like Southern California, Florida, Phoenix, Atlanta, Chicago and Las Vegas. (Forbes)

The aftermath of the 2008 crisis rubbed it into our faces, just how financial institutions will relentlessly capitalize on widespread distress, turning the misfortune of homeowners into lucrative investment opportunities.

The intention is simple: the rich get richer at the expense of the middle class and the poor.

The Policies That Are Accelerating the Collapse

Monetary Policy Failures

The Federal Reserve's mismanagement of interest rates has been a major catalyst for economic instability. For years, the Fed kept interest rates artificially low, flooding the market with cheap money and inflating asset bubbles in stocks, real estate, and corporate debt. When inflation became unmanageable, the Fed abruptly reversed course, hiking interest rates at an unprecedented pace. This sudden shift put immense pressure on businesses and consumers who had taken on debt during the low-rate era, triggering widespread financial distress.

The Fed's dual mandate of maintaining price stability and full employment has often resulted in policy decisions that favor one goal over the other, leading to unintended consequences. The prolonged period of low interest rates encouraged excessive borrowing and risk-taking, setting the stage for future economic vulnerabilities.

The Silicon Valley Bank Collapse

In 2023, Silicon Valley Bank (SVB) collapsed due to its overreliance on long-term bond investments that depreciated sharply as interest rates rose. The failure of SVB sent shockwaves through the financial sector, exposing vulnerabilities in other regional banks. The federal government responded with selective bailouts, favoring large institutional depositors while smaller businesses and individuals faced uncertainty.

The SVB collapse demonstrated the interconnectedness of the financial system and the potential for localized crises to escalate into systemic risks. The government's response absolved itself of all morality and fairness by providing preferential treatment to certain institutions and individuals.

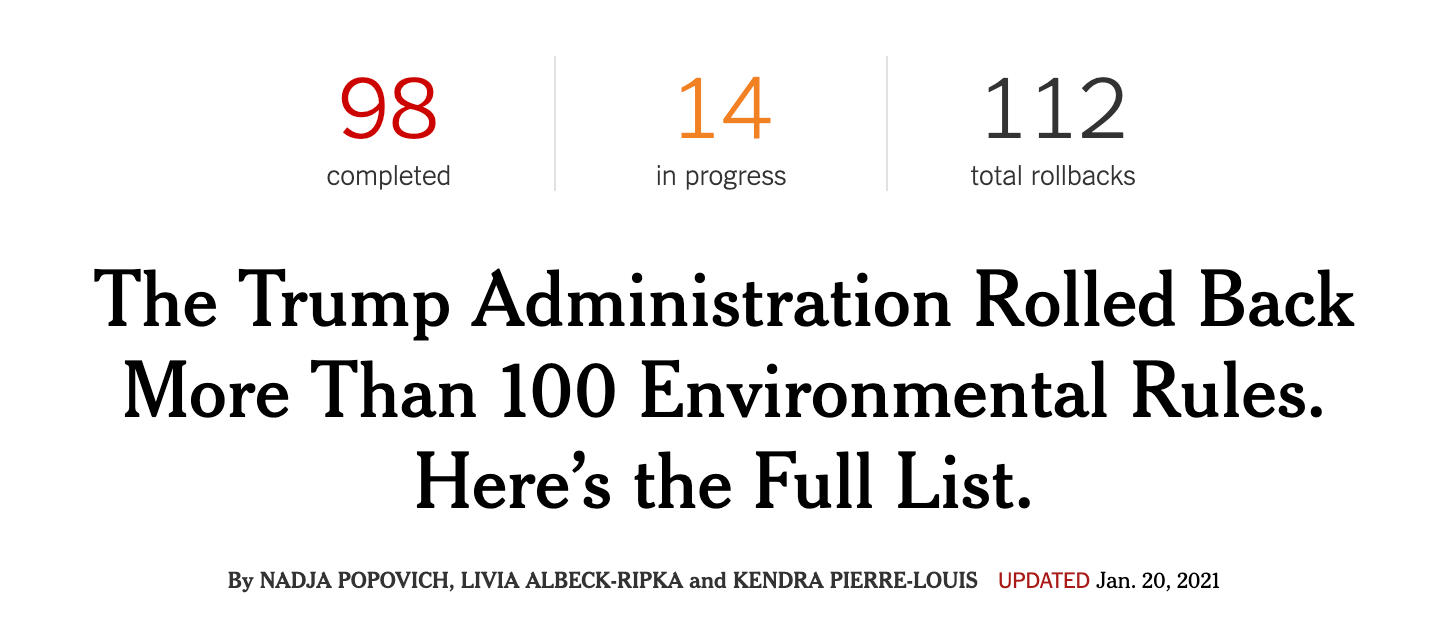

Government Deregulation and Corporate Greed

Just in the past month, well over 100 regulations were rolled back.

The deregulation agenda, is sold in the name of economic efficiency and innovation. While, in reality, deregulation is creating an environment ripe for exploitation and abuse. The lack of effective regulatory oversight has allowed corporations to double down on prioritizing short-term profits over long-term stability and societal well-being.

In short: the ends to make more money in the shortest amount of time, justifies the means of damages to the environment and the social contract.

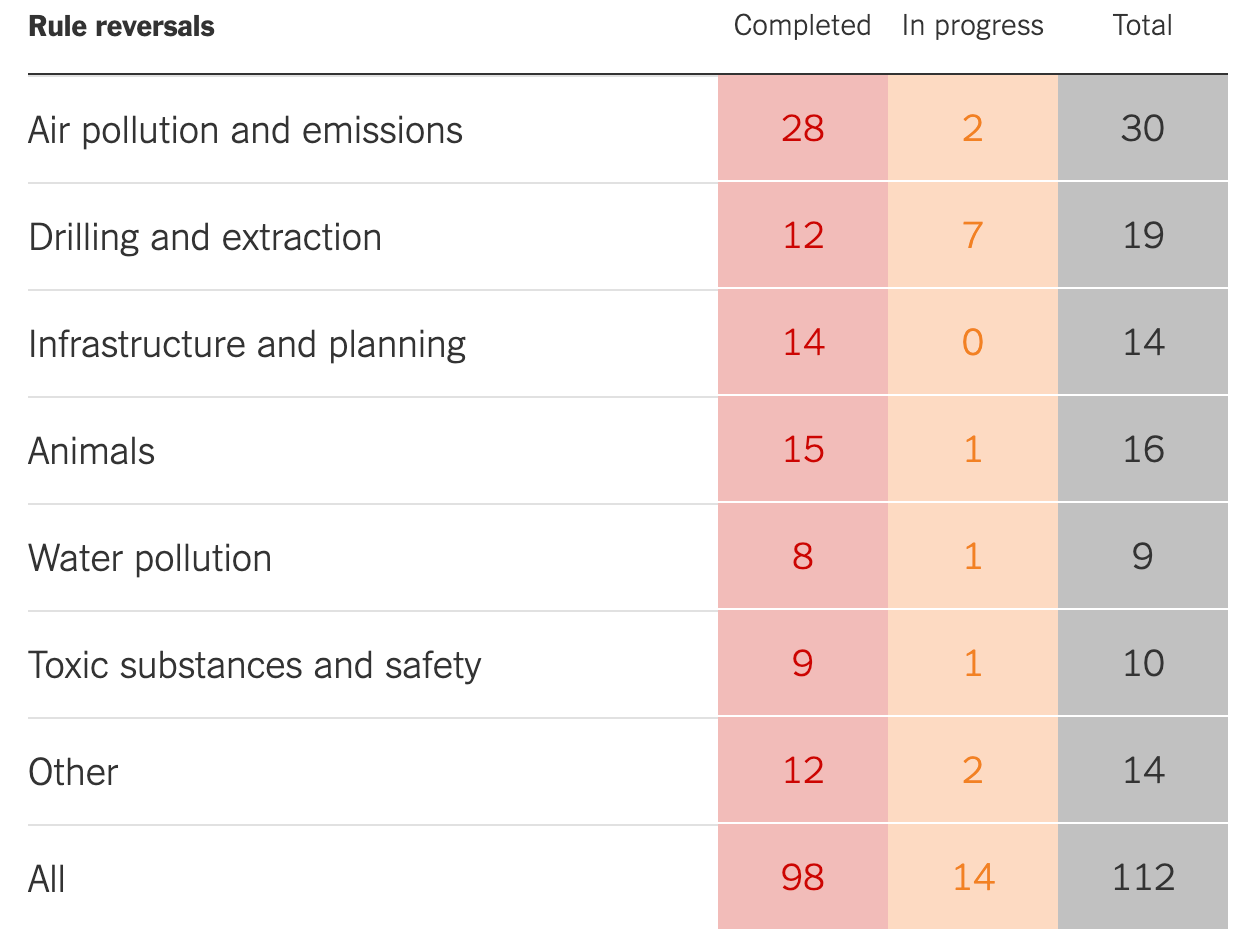

The Airline and Retail Industry Contractions

Deregulation has allowed industries such as airlines and retail to consolidate into a few dominant players. During the pandemic, airlines received billions in government bailout funds while cutting jobs and increasing ticket prices. Similarly, major retailers have used their market dominance to eliminate competition, forcing smaller businesses to close while hiking prices post-recession.

These industry contractions demonstrate how deregulation can lead to market concentration, reduced consumer choice, and the exploitation of workers. The concentration of power in the hands of a few corporations allows them to dictate terms and conditions, stifling innovation and undermining economic fairness.

What is true for the airline industry, is equally true for the grocery chain industry, or just about any other household/brand name article. Consolidation and funneling to 10 overarching players, who control the market, creates suffocating monopolies. The “Free Market” has long died a lonely death.

The Wealth Extraction Playbook

Corporate America has perfected the art of wealth extraction through any number of reprehensible tactics: stock buybacks, wage suppression, and mass layoffs.

During their stock buyback spree, Low-Wage 100 CEOs’ personal stock holdings increased more than three times as fast as their firms’ median worker pay. At the 65 buyback companies where the same person held the top job between 2019 and 2022, the Low-Wage 100 CEOs’ personal stock holdings soared 33 percent to an average of $184.7 million. Median pay at these firms rose only 10 percent to an average of $31,972.

Although technically illegal in the US until 1982, buybacks have become the preferred way for companies to throw off cash. That's partly because companies can be more opportunistic about them, but it's also because they essentially reward shareholders with capital gains, rather than income, which is generally more tax efficient. Apple has been the king of the buyback, splurging $500bn+ on purchasing more than one-third of its outstanding shares in the last 10 years.

1982?

If your head went straight to Reagan, you’re not wrong.

Cowboy Ronny appointed John Shad to head the SEC in 1981. The former vice chair of E.F. Hutton & Company Inc, a major Wall Street securities firm, Shad was the first financial executive to head the agency in 50 years - with immediate impact. In 1982, the SEC adopted rule 10b-18, which provides a “safe harbor” for companies in stock buybacks. As long as companies stick to specific parameters — such as not buying more than 25 percent of the stock’s average daily trading volume in a single day — they won’t be dinged for stock manipulation.

Taxpayer support for huge CEO-worker pay gaps

What makes all this even more upsetting? Taxpayers are actually supporting, through federal contracts, the buyback-fueled disparities at FedEx and 50 other Low-Wage 100 firms.

FedEx pocketed $6.2 billion in fiscal years 2020-2023 for mail services for the Veterans Administration and other agencies. The largest federal contractor in the Low-Wage 100 is another company known for union-busting. Yes, I’m looking at you, Amazon. Over the past few years, Amazon has pocketed more than $10 billion in web services deals from Uncle Sam while spending nearly $6 billion repurchasing their shares.

Buyback practices reflect a fundamental shift in corporate priorities, where maximizing shareholder value has become the overriding objective, almost always at the expense of workers, consumers, the broader economy, and social responsibility.

Recent Tech Sector Layoffs

Throughout 2023-2024, major technology companies executed massive layoffs despite reporting substantial profits. These workforce reductions were driven primarily by shareholder demands rather than genuine financial distress. Fiduciary responsibility, again, amplified the ruthless nature of corporate cost-cutting measures, at the expense of the employee, their families, and the employee’s spendable income. The latter affects any business the former employee spent money at. Thus, each layoff has an impact on the economy.

These layoffs show the growing disconnect between corporate profitability and employee welfare. The relentless pursuit of efficiency and cost reduction has created a race to the bottom, where workers are treated as disposable assets rather than valuable contributors to long-term success.

The Looming Economic Catastrophe: Echoes of 1929

A perfect storm is brewing in the global economy, and the United States occupies the epicenter of what could become the most devastating financial collapse in modern history, potentially surpassing the stock market crash of 1929. The warning signs are unmistakable: a severely overvalued stock market, multiple asset bubbles ready to burst, and a financialized economy increasingly detached from real production. The crucial difference between 1929 and now lies in the intricate interconnectedness of global financial systems and the unprecedented scale of market valuations.

Before I breathe down your neck with an old story again, you can read it here:

Brace for Impact: The Crash is Coming

The United States stock market is atrociously overvalued, and to make matters worse, the country is gearing up for a global trade war - “the likes you’ve never seen before!”

In a Nutshell: What may come, is the Biggest Bubble in History

We've witnessed numerous bubbles: the 1929 recession, the dot-com crash of 2000, and the 2008 financial crisis. However, today's economic environment dwarfs them all in scale and potential impact. The Buffett Indicator, which measures stock market valuation by comparing total market capitalization to GDP, currently sits at 211%. For perspective, the dot-com bubble peaked at 130%, while 1929's market crash preceded an 80% ratio. These numbers suggest we've moved beyond mere overvaluation into unprecedented territory. Adding to the concerns, the price-to-earnings (P/E) ratios of major stocks have reached historically unsustainable levels. Market insiders and corporate executives have been quietly unloading billions in stock over the past two years, suggesting they know what may unfold.

The Global Trade War and Its Fallout

The current trajectory towards a global trade war, particularly with aggressive protectionist policies, threatens to significantly destabilize the U.S. economy. Trump’s tamper tantrum tariffs (3T), will isolate the U.S. from traditional trading partners and damage established economic relationships. The outcome will be that the American consumer is left holding the bag.

Your wages won’t increase, while tariffs will jack prices into oblivion.

Since we can’t control what Trump and his misfits are damaging, courtesy of the power awarded to them - legitimately or not - we have to prepare for the worst, while hoping for the best.

How to Prepare for the Economic Implosion

I am not a financial advisor. Thus, the suggestions below were synthesized from multiple sources, co-authored with AI, and are to be considered with extra caution! As always, there are numerous strategies, and never a “one size fits all” approach, except one: we must not give up and we must unite.

To be perfectly honest, the suggestions below, are too lukewarm for me. I prefer a more relentless approach. Equally relentless as the oligarchs greed, and corporate absolution of socioeconomic responsibilities. I favor a the GAS revolution.

Hypothetical: The GAS Blueprint

As I contemplate what it would mean for the American people to unite and take charge of the country, I also recognize that I am “leaning way out of the window” with this Substack.

Strengthening Financial Resilience (commentary in italics)

· Diversify Investments: Relying solely on the stock market is risky. Consider investing in tangible assets such as precious metals, land or real estate, and commodities.

This is a generalized truth. Asset diversification is generally a good idea.

· Reduce Debt: High-interest debt can become unmanageable during economic downturns. Paying down credit card balances and loans can help prevent financial distress.

Depending on how the USA continues its path toward fascism, high-interest debt may the least of our worries. Moreover, in case we enter a revolutionary state, debt is inconsequential, as the dollar will have lost its buying power.

· Increase Savings: Building a six-month emergency fund can provide a financial buffer against job loss or unexpected expenses.

This emergency fund goes beyond cash on hand. This should include resources such as food, clothing, energy, etc.

Alternative Investments and Wealth Preservation

Traditional investment avenues may become increasingly volatile. Consider exploring alternative financial strategies:

· Gold and Silver: Precious metals historically retain value during economic instability.

· Decentralized Assets: Alternative financial systems may offer hedge potential against fiat currency devaluation.

· Farmland and Self-Sufficiency: Investing in land and local food production can provide financial security and tangible survival resources.

This is where it’s at for me, to be honest. Farmland, self-sufficiency, bartering, and communal relationships.

Community-Driven Economic Models

As large institutions prioritize shareholder profits over consumer well-being, local economic resilience becomes the answer.

· Bartering and Local Trade Networks: Establishing or join community exchange systems can help reduce reliance on corporate supply chains.

They are all around you. If you haven’t found them yet, pay attention and ask questions. Local CSAs are everywhere, and if you happen to have a garden, then by all means…start producing!

· Worker Cooperatives: Employee-owned businesses can provide job stability and fair wages in an economic downturn.

This is tricky, as it requires you to leave your current employer. It may be beneficial to explore the option, though.

· Mutual Aid Networks: Grassroots organizations that provide food, housing, and financial assistance can mitigate economic hardship at the community level.

These aid networks will find it increasingly challenging to attract sufficient funding. Thus, a mutual aid network, built on a barter system, is likely a good hedge.

Example: Argentina's Economic Collapse and Local Adaptation

During Argentina's 2001 financial crisis, the collapse of the banking system led to a surge in community-based economies. Citizens relied on barter systems and local currencies to survive hyperinflation, providing a potential model for resilience in the face of financial collapse.

The next article features and AI analysis, and a rather argumentative DeepSeek.

The Analysis

Since I’ve been accused of being overly pessimistic, although I consider myself a hardcore realist, I asked DeepSeek and GPT to evaluate the previous article. Join 4000+ Readers & Never Miss a Post!

This was a lot to chew on. If you’re still with me, jump into the comment section and let us know what you think.

###

~Z.

Very thorough article and thank you for adding history and other points of connection. Sadly I think we are past the point of no return.. For marginalized groups I guarantee you we are. We've all been scraping by especially women because the way society is set up, we're set up to fail without men and we're set up to fail once the man we attach ourselves to dies. On average, women live 5-15 years longer than our male spouses, so I can guarantee the impact is already felt. It's only going to get worse for those of us in vulnerable and marginalized groups. Frankly speaking from the perspective of my demographic, women always take the brunt of these trendings worse. We bear almost the full brunt of it. We always have because that's how society was set up--for us to not be able to survive without men. So social security cuts we're going to feel them the worst-- because we live longer. I think this does, in fact, deserve an analysis from another perspective.. Or a few..

See you on the beach my friend...we are well past the point of no return...