Is the Next Recession Engineered?

They're working on the biggest American rug pull in history

The Intentional Engineering of Economic Crisis

Since the Trump regime has reclaimed the White House, the economic discourse has shifted from hope and progress to fear and concern. The regime’s actions suggest that the United States may be on a deliberately constructed trajectory toward financial destabilization. The intention is to disadvantage the vulnerable, the poor, and the middle class while creating a windfall of money for the ultra-wealthy and corporations.

Recessions are often framed as inevitable market cycles, although history proves that an economic crisis can be intentionally engineered. Trump’s economic policies reflect a striking convergence of strategic decision-making, historical precedent, and sector-specific vulnerabilities, raising serious red flags about whether the upcoming downturn is deliberately orchestrated rather than the organic outcome of market developments.

The Strategic Playbook for Economic Downturns

At first glance, current policy initiatives appear designed to stabilize inflation, which hovers at 3%, and promote economic growth.

However, a closer look shows a more destructive possibility: policies that restrict demand while ostensibly boosting supply may be accelerating the very conditions necessary for a recession. When economic advisors advocate for reducing aggregate demand, often achieved through higher unemployment and lower disposable income, the real-world impact is a deliberate suppression of consumer spending. The implications of this kind of policy extend far beyond short-term inflation control and could be setting the stage for long-term economic distress, a recession, and quite possibly, a depression.

Among the many “to good to be true” examples of this dynamic is the ongoing debate over payroll tax cuts. While marketed as a relief measure for workers, payroll cuts also reduce government revenue, often necessitating future spending reductions that further depress demand.

Where will those spending reductions come from? If your head is now going toward “social security” and “Medicare”, you’re not far off.

Similarly, the imposition of widespread tariffs, aiming to strengthen domestic industries, has already had the opposite effect. Costs for manufacturers AND consumers have steadily risen since the Trump regime took the helm.

(Yes, I am aware that the White House has little to do with the increase in egg prices, which are largely caused by bird flu. However, in a Trumpian world, eggs are the measure of economic health, and the sales price was supposed to come down…)

Meanwhile, government spending freezes have triggered hiring slowdowns across multiple sectors, from healthcare to education, accentuating the economic fragility policymakers claim to be mitigating.

Statements from policymakers, such as Federal Reserve Chair Jerome Powell’s acknowledgment that “some economic pain” is necessary to combat inflation (Federal Reserve, 2023), illustrate the trade-offs involved in these policy decisions.

Trump’s policies and Musk’s unmitigated destruction of government departments will lead to a recession, perhaps even a depression. But, fear not, they will rebuild the United States from the ground up, with a strong middle class in mind, elevating everyone, sharing American prosperity…

Historical Precedents of Manufactured Economic Crises

The notion that economic crises occur naturally ignores a rather critical aspect of financial history: economic downturns are often the result of deliberate manipulation. Consider the financial panic of 1907, when major banking institutions withheld liquidity from smaller competitors, worsening the crisis and paving the way for the creation of the Federal Reserve (Moen & Tallman, 2000). Similarly, the Latin American debt crisis of the 1980s was provoked by policy decisions made by international financial institutions, which transformed manageable economic pressures into full-scale economic collapses, benefiting external investors at the expense of local economies (Stiglitz, 2002).

Economic historian Adam Tooze argues that financial crises are frequently politically managed rather than purely market-driven (Tooze, 2018), reinforcing the essay’s thesis that economic downturns can be engineered.

Too Big to Fail.

More recently, the 2008 financial crisis serves as a stark reminder of selective intervention. The decision to let Lehman Brothers collapse while bailing out other institutions reshaped the banking landscape, consolidating power among a few surviving giants (Tooze, 2018). Today, the refusal to intervene in the struggles of regional banks, such as the case with First Republic 2.0, mirrors this selective crisis management, once again establishing thoughts about an orchestrated reshaping of financial markets.

Treasury Secretary Janet Yellen has commented on the need for “de-decisive action” to stabilize financial institutions while choosing not to extend guarantees to all regional banks (U.S. Treasury, 2023), further clarifying the selective nature of deliberate interventions.

“Good enough for some, not good enough for others”, the decision-making parameters of who’s worthy of being saved versus who’s left to rot, are anyone’s guess. The public can speculate. Beyond the finance sector, though, there is more at risk. The United States as a whole, is standing on shaky legs…

Industry-Specific Vulnerabilities and Systemic Risks

A closer look at individual sectors shows just how current policies disproportionately impact different industries. The following serves in support of the argument that the economic trajectory is neither incidental nor unavoidable.

Manufacturing and Trade Disruptions

The imposition of tariffs and supply chain disruptions disproportionately burden manufacturers reliant on global markets. Rising input costs force companies into difficult choices: either absorb losses, raise consumer prices, or cut labor costs. Notably, smaller manufacturers, frequently lacking the financial reserves to endure extended market instability, will face increased risks of acquisition by larger corporate conglomerates.

The automotive and semiconductor industries are particularly vulnerable, with steel and aluminum tariffs inflating costs by 20-30% (U.S. Chamber of Commerce, 2023). The ongoing trade disputes with China, particularly over semiconductor production, further compound these pressures, as highlighted in recent Commerce Department reports on chip supply chain fragility (Department of Commerce, 2023). Remember, in 2023 we were still in what’s considerable as “good and responsible” times.

Trump’s assistance in adding a tariff-induced trade war to the ledger, will either bankrupt any number of the 32+ million small businesses in the USA, impose higher prices upon consumers, or most likely, result in a blend of both. Also, make no mistake, once prices have gone up, and corporate takeovers have taken place, prices will not come down. The consumer has been conditioned, profits must be maintained, and we will all pay the price of an incompetent administration.

The ultra-wealthy see it coming, and they’re preparing.

Brace for Impact: The Crash is Coming

The United States stock market is atrociously overvalued, and to make matters worse, the country is gearing up for a global trade war - “the likes you’ve never seen before!”

The Real Estate Sector’s Growing Wealth Disparities

Housing markets have historically been a bellwether for economic downturns, and current trends suggest a precarious future. Institutional investors have aggressively increased their acquisition of single-family homes, seizing opportunities presented by rising interest rates and declining consumer purchasing power.

In many metropolitan areas, institutional investor ownership has surged by 15-20%, pricing middle-income buyers out of the market (Urban Institute, 2023), and they are not showing any signs of slowing down. Quite on the contrary.

While institutional investors often provide rental stability and liquidity during downturns, their dominance also results in market control and diminishing affordability. While the Biden administration has called for limits on institutional ownership of residential housing, no major legislative action has followed (White House, 2023), and the Trump regime is sure to release the reigns to laissez-faire real estate. After all, that’s how he identifies: as Real Estate Mogul.

Healthcare: A Looming Crisis in Accessibility

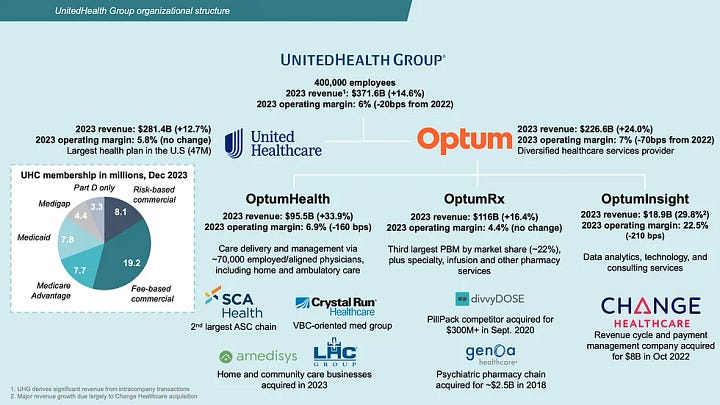

Economic instability poses significant risks to healthcare institutions, particularly community hospitals and independent physician practices. As government spending contracts and uninsured rates climb due to job losses, hospitals face mounting financial pressures that could accelerate industry consolidation.

Recent surveys indicate that nearly 40% of rural hospitals are at risk of closure (American Hospital Association, 2023), while independent mental health providers report increasing financial distress, threatening access to critical services.

The proposed Medicare and Medicaid budget cuts will dramatically increase these challenges, further limiting healthcare access for vulnerable populations. The recent closure of St. Luke’s Hospital in Gary, Indiana, offers a stark example of this trend.

However, fear not, United Health is here to save the day!

The Tech Sector’s Funding Slowdown

While tech giants have the financial resilience to withstand downturns, smaller startups face existential threats from declining venture capital investments. Recent data shows a 30% decline in early-stage funding, particularly affecting AI and clean technology ventures (CB Insights). Adding to the misery, are the numerous tech layoffs. For instance, Zuckerberg “warned” of a difficult year ahead, as they’re laying off 3000+ software engineers. Arguably, this is a sign of the times, in that AI is changing the industry, yet, in the artificially upheld absence of social safety nets, the consequences of unemployment and a strained employment market, will be significant.

Retail and Small Business Survival

Retail, an industry already undergoing rapid transformation due to e-commerce dominance, faces additional pressures from declining consumer spending. Independent retailers, many of whom operate with slim profit margins, are particularly vulnerable. A recent survey found that 60% of small business owners have less than three months of operating reserves, making them especially susceptible to economic shocks (National Retail Federation, 2024). Similarly, the restaurant industry—where independent establishments report average profit margins below 3%—faces existential threats as consumers cut back on discretionary spending.

They’re setting up to murder Americans

The convergence of irresponsible policy decisions, market dynamics, and institutional behavior suggests that today’s economic trajectory is not merely the result of poor governance. The Trump regime is rolling out efforts to reshape financial markets and economic power structures, while simultaneously eradicating the vulnerable, the poor, and rendering the middle class helpless.

The GOP’s budget for 2025

The proposed House GOP budget resolution is a significant threat to vulnerable populations and increasing existing inequalities in American society. They plan to cut $2 trillion from Medicaid over the next decade while simultaneously pushing for tax cuts that primarily benefit the wealthy.

The Antidote

Hypothetical: The GAS Blueprint

As I contemplate what it would mean for the American people to unite and take charge of the country, I also recognize that I am “leaning way out of the window” with this Substack.

###

~Z.

Look up the Network State. A recession is just the beginning.

While at it, they will leave the American people with no safety net making matters worse. Sharpen the pitchforks.